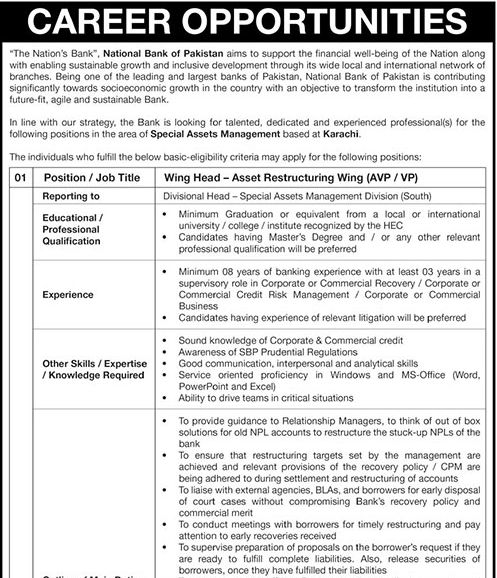

National Bank of Pakistan NBP Jobs: The National Bank of Pakistan (NBP) has announced career opportunities in the Special Assets Management area for the following positions based in Karachi:

National Bank of Pakistan NBP Jobs

1. Wing Head – Asset Restructuring Wing (AVP/VP)

- Reporting to: Divisional Head – Special Assets Management Division (South)

- Qualifications:

- Minimum graduation from a recognized university (Master’s degree or relevant professional qualifications preferred)

- Minimum 8 years of banking experience, with at least 3 years in a supervisory role (Corporate/Commercial Recovery, Credit Risk Management, or Business)

- Knowledge of relevant litigation preferred

- Skills:

- Strong knowledge of Corporate & Commercial credit, SBP Prudential Regulations

- Strong communication, interpersonal, and analytical skills

- Proficiency in MS-Office, ability to drive teams, and critical thinking

- Responsibilities:

- Restructuring NPL accounts, ensuring targets are met, coordinating with external agencies, and handling legal matters.

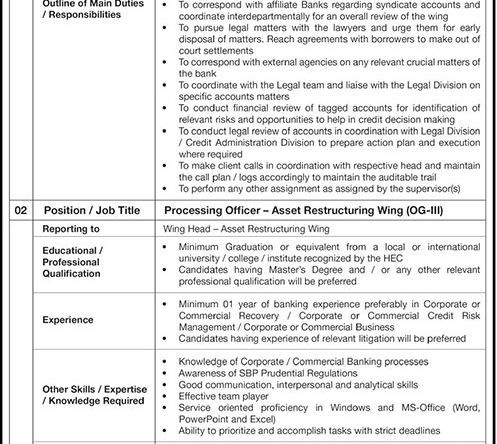

2. Processing Officer – Asset Restructuring Wing (OG-III)

- Reporting to: Wing Head – Asset Restructuring Wing

- Qualifications:

- Minimum graduation from a recognized university (Master’s degree or relevant professional qualifications preferred)

- Minimum 1 year of banking experience (preferably in Corporate/Commercial Recovery or Credit Risk Management)

- Knowledge of relevant litigation preferred

- Skills:

- Knowledge of Corporate/Commercial Banking processes, SBP Prudential Regulations

- Good communication, interpersonal, and analytical skills

- Proficiency in MS-Office, ability to prioritize tasks

- Responsibilities:

- Assisting in the development and implementation of strategies for remedial management of non-performing portfolios, preparing proposals for settlements, and ensuring compliance with regulations.

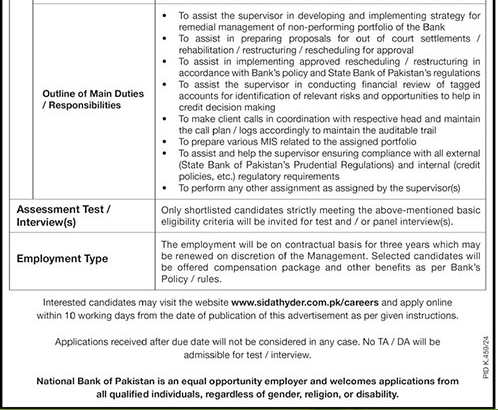

Application Information

- Contract-based jobs for three years.

- Apply at www.sidathyder.com.pk/careers. (Within 10 days)

- Only shortlisted candidates will be contacted.

This opportunity is open to all qualified individuals regardless of gender, religion, or disability.

See our latest articles to increase your chances of getting a job.

How to make a CV

Interview tips and tricks

See our blog page for more articles

About NBP

The National Bank of Pakistan (NBP) was Established in 1949, the bank has played a crucial role in the country’s financial sector. Here are some key points about NBP:

Key Features:

- Government Ownership: NBP is primarily owned by the Government of Pakistan, making it a state-owned institution. It plays a vital role in implementing government policies, particularly in sectors like agriculture, industry, and international trade.

- Wide Network: The bank operates a vast network of branches across Pakistan and overseas, particularly in countries with significant Pakistani diaspora populations.

- Services: NBP offers a full range of banking services, including retail, corporate, investment, and Islamic banking. It also provides government-related services, such as pension disbursements and managing funds for various public-sector entities.

- Specialized Financial Services: The bank has specialized products and services for sectors like agriculture, SME (Small and Medium Enterprises), and corporate finance. It also facilitates government initiatives in financial inclusion and poverty alleviation.

- Digital Banking: NBP has been expanding its digital banking services, offering online and mobile banking platforms to its customers to compete in the rapidly evolving financial technology (fintech) space.

- Corporate Social Responsibility (CSR): NBP is active in CSR activities, including education, healthcare, sports, and disaster relief, contributing to the development and welfare of the country.

Challenges:

Despite its large scale and government backing, NBP faces challenges common to state-owned enterprises in Pakistan, including bureaucratic inefficiencies, political influence, and competition from private-sector banks.

Global Presence:

NBP also has international operations, with branches in several countries, including the United States, the United Kingdom, the United Arab Emirates, and China. These cater to the banking needs of overseas Pakistanis and international trade.

Would you like more detailed information about NBP, such as its recent financial performance, specific services, or current challenges?

FAQS

- How can I open an account with NBP?

- You can open an account at any NBP branch by providing the required documents, including your CNIC (Computerized National Identity Card), proof of address, and a passport-sized photograph. Account opening forms are available at branches or can be downloaded from the official website.

- What types of accounts does NBP offer?

NBP offers various account types, including savings accounts, current accounts, fixed deposits, foreign currency accounts, and Islamic banking accounts. - How can I check my NBP account balance?

You can check your account balance via NBP’s online banking portal, mobile banking app, or by visiting any NBP ATM or branch. - Does NBP offer mobile banking?

Yes, NBP offers mobile banking through its app, NBP Digital. The app allows you to perform various transactions, such as checking your balance, transferring funds, and paying bills. - How can I register for NBP Internet Banking?

You can register for NBP Internet Banking by visiting the official NBP website and clicking on the internet banking portal. Follow the registration process by providing your account details and setting up security questions. - How can I contact NBP customer support?

You can contact NBP customer support through their 24/7 helpline at 111-627-627. Alternatively, you can reach out via email or by visiting a branch.